Every day, while scrolling through the internet or flipping through newspapers, you probably come across news of startups going public. But why is there so much buzz around startup IPOs? What’s driving this trend? Let’s break it down.

What Exactly is an IPO?

An Initial Public Offering (IPO) is when a previously private company raises money from the public for the first time by listing its shares on the stock exchange. This marks its transition from a private entity to a publicly listed company—hence the term “going public.”

Before launching an IPO, the company sets a price and offers shares for sale. Investors who buy these shares become part-owners (shareholders) of the company.

Now, here’s an interesting question: Why would a startup willingly give up control by fragmenting its ownership?

The answer is simple—Capital.

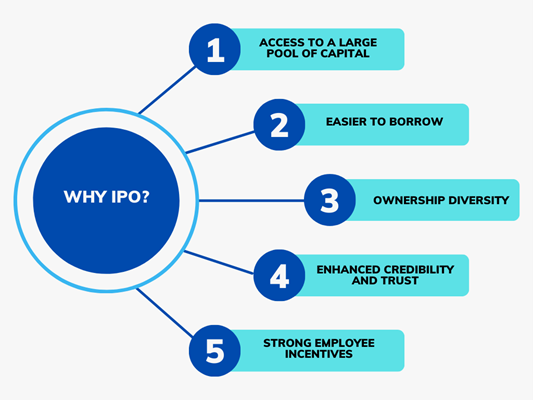

Why Do Startups Choose IPO?

In the early stages, startups rely on bootstrapping, funds from friends and family, or private investors. However, as they enter the growth phase, operational costs soar, and cash flow often falls short. To scale further, startups need fresh funds, and while there are multiple financing options, IPOs offer several unmatched advantages.

1) Large Pool of Capital

One of the biggest advantages of going public is access to a large pool of capital. Unlike venture capital or private equity funding, which is limited and comes with stringent conditions, an IPO allows startups to raise substantial funds from the public. For instance, Zomato’s 2021 IPO raised ₹9,375 crore ($1.3 billion), giving it the financial muscle to expand its delivery network, invest in technology, and make strategic acquisitions like Blinkit. This influx of capital helped Zomato fortify its market leadership against competitors like Swiggy, demonstrating how IPOs fuel long-term growth.

2) Easier to Borrow

Going public also makes it easier to borrow as lenders have greater confidence in publicly listed companies due to their financial transparency and regulatory compliance. Take the example of PolicyBazaar (PB Fintech), which went public in 2021. Post-IPO, its improved credit profile made it easier to secure loans and expand its insurance and lending services.

3) Ownership Diversity

Another crucial benefit of an IPO is ownership diversity. Before listing, startups are usually controlled by founders and a handful of venture capitalists. However, after an IPO, ownership is spread across thousands of institutional and retail investors.

4) Enhanced Credibility and Trust

Beyond financial gains, IPOs significantly boost credibility and trust. Publicly traded companies must comply with strict SEBI (Securities and Exchange Board of India) regulations, undergo regular audits, and maintain transparency. This makes them more trustworthy in the eyes of investors, customers, and business partners.

5) Strong Employee Incentive

Finally, IPOs create strong employee incentives, helping companies attract and retain top talent. Many startups offer Employee Stock Ownership Plans (ESOPs) as part of their compensation packages, which become highly valuable post-IPO.

What 2024 Startup IPOs had in store?

With these benefits in mind, startups strategically time their IPOs to maximize their impact. As Sahil Barua, CEO of Delhivery, mentions in Startup Compass, “while going public does subject a company to the vagaries of the market, it is often easier to raise money from a large pool of public market investors than it is from a select group of private investors.”

This statement rings true for 2024, a landmark year for startup IPOs, proving that businesses are increasingly viewing public listings as the best route for growth and expansion.

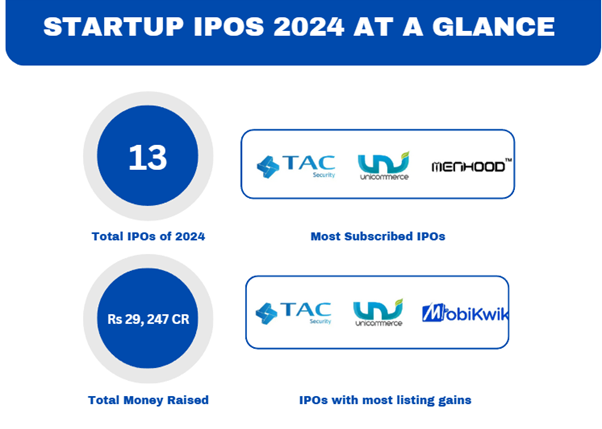

The numbers speak for themselves—a record 13 startups went public in 2024, raising ₹29,000 crore ($3.4 billion), with the number expected to double in 2025. The numbers stood at 6 startup IPOs in 2023 and 6 in 2022. This unprecedented momentum in 2024 indicates that Indian startups are no longer hesitant about going public; they see it as an essential step to scaling operations, gaining credibility, and attracting institutional investors.

The 2024 IPOs spanned multiple industries like logistics, SaaS, fintech, foodtech, e-commerce, and traveltech. Some of the biggest names that went public in 2024 along with the gain post listing includes MobiKwik – 57.71%, Unicommerce – 117.59%, TAC Security – 173.58%, TBO Tek – 55%, FirstCry, Ixigo, and Trust Fintech – 30-50% gains, Ola Electric listed flat, reflecting market caution.

2025: The Year of Startup IPOs?

The momentum isn’t slowing down. In fact, more than 50 startups are gearing up to go public in 2025, a massive leap from 13 in 2024!

Some of the highly anticipated IPOs include Ather Energy, Boat, PhysicsWallah, Zepto, PayU, and Pine Labs. These upcoming IPOs will span across e-commerce, fintech, and proptech, with several companies awaiting SEBI approval.

As V Balakrishnan, Chairman of Exfinity Ventures, puts it: “The Indian startup ecosystem is now much more mature, and capital markets are responding positively.”

Though Indian Markets are paving the way for startup ecosystems, there are layers which remain unanswered. We’ve uncovered why startups go public and how 2024 set new records, the next question remains—what’s fueling this unprecedented IPO boom from 13 in 2024 to 50 in 2025?

Stay tuned to Startup Shiksha as we decode this trend in our subsequent blogs!